Managing online payments and customer relationships across different platforms creates unnecessary friction. That’s where PayPal integrations step in to simplify things. They bridge the gap between your payment data and your CRM.

With PayPal and Salesforce integration, businesses can instantly sync transactions with customer profiles. No more manual entry. No more switching between tabs just to match a payment with a contact.

The result? Smoother workflows, faster service, and accurate financial records – all inside Salesforce. You can view payment history, track invoices, and even automate follow-ups without leaving your CRM.

In today’s digital-first economy, customers expect speed and personalization. You can’t deliver that with disconnected tools. That’s why so many businesses are adopting PayPal Salesforce integration as a core strategy.

Whether you’re a startup or a large enterprise, this integration makes your sales and finance teams more connected. It brings together two powerful platforms to streamline operations and improve decision-making in real time.

Why You Need PayPal Salesforce Integration

Managing payments outside your CRM slows you down. With PayPal integration with Salesforce, you can bring payment tracking inside your workflow. That means less jumping between platforms and fewer errors.

When you connect your systems, PayPal transaction data syncs directly with Salesforce records. You’ll always know who paid, when, and how – without updating anything manually.

This kind of automation speeds up everything. Sales teams see real-time payment status, and finance teams get clean, accurate data. It’s smart, simple, and efficient.

PayPal Salesforce integration doesn’t just improve internal processes but your customer experience too. Faster transactions lead to quicker confirmations and happier clients.

If you’re still switching tabs or chasing updates, this integration fixes that. It makes your CRM the central hub for communication, sales, and payments all in one place.

How to Set Up the Integration

Setting up a PayPal Salesforce integration starts with the right tools and a clear plan. You’ll need both platforms configured properly before you connect them. Once everything’s in place, you can automate payment data flow and streamline operations.

Requirements & Pre-Setup

- Before starting the PayPal to Salesforce Integration, make sure you’ve got the basics ready.

- You’ll need a PayPal Business account with sandbox access for testing.

- Your Salesforce edition should support API access, and you must have admin credentials.

Step-by-Step Setup

- First, log in to the PayPal Developer Dashboard and create a sandbox environment.

- Generate your Client ID and Secret – you’ll need these to connect with Salesforce.

- Next, go to Salesforce Setup and create a Connected App with OAuth 2.0 settings.

- After that, configure API authentication using the credentials from PayPal.

- This ensures both platforms talk securely to each other.

- You can also define scopes to control what data is shared during the integration.

Finalize Integration

- Now test your integration by sending webhook events from PayPal to Salesforce.

- Set up Flows or write Apex code to trigger actions when payments are made.

- Once tested, move everything to production and activate live sync for real-time updates.

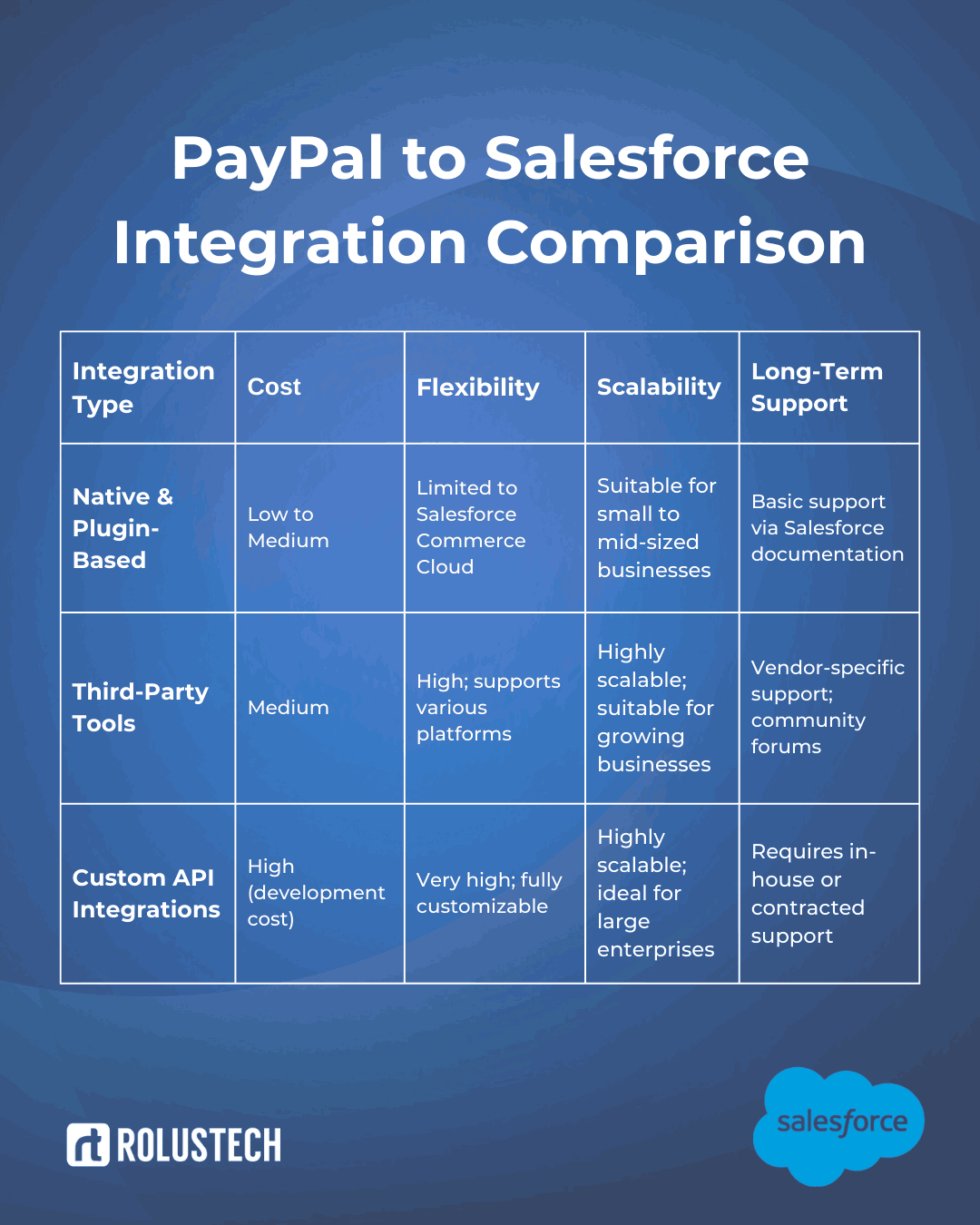

Types of PayPal Salesforce Integration

Native & Plugin-Based Integrations

For businesses already using Salesforce Commerce Cloud, PayPal integration Salesforce can be easily achieved through native plugins. These tools streamline the setup process and allow merchants to process payments directly within the Salesforce ecosystem.

Additionally, the Salesforce Payments Beta offers another option for integrating PayPal, though it is currently only available to selected users.

Third-Party Tools

If you’re looking for a solution that doesn’t require custom coding, third-party tools like Zapier, Workato, and Mulesoft offer an excellent alternative. These platforms help connect PayPal website integration and other services to Salesforce with pre-built templates.

They’re perfect for businesses that want speed and flexibility without the complexity of custom code. For example, using Shopify PayPal integration with these tools helps manage sales data smoothly.

Custom API Integrations

For complete control, a PayPal to Salesforce Integration using the PayPal REST API and Salesforce Apex allows you to build tailored solutions. This method requires more technical know-how, but it enables businesses to create a secure and robust payment workflow that fits their specific needs.

With this integration, you can sync transaction data directly from PayPal to Salesforce for real-time insights.

Secure Payment Gateway Setup

Regardless of which method you choose, setting up a secure payment gateway is essential. Whether you opt for native tools, third-party integrations, or a custom API, ensuring that all payment data is securely handled is crucial to maintaining your customers’ trust and meeting compliance standards.

PayPal to Salesforce Integration Comparison

Advantages of PayPal Salesforce Integration

- Faster payment collections: By integrating PayPal with Salesforce, transactions are processed and recorded in real time, ensuring quicker payments. This allows businesses to access funds faster, improving cash flow and reducing the time spent on manual invoicing or chasing payments.

- Reduced cart abandonment: A seamless checkout experience is key to reducing cart abandonment. With PayPal integrated into Salesforce, customers can easily complete transactions without leaving the platform, leading to higher conversion rates. Simplified payment processing encourages customers to complete their purchases, ultimately boosting sales.

- Real-time sales tracking and accounting sync: Integration ensures that every transaction made through PayPal is instantly synced with Salesforce, providing real-time updates. This eliminates the need for manual data entry, ensuring that sales records are always accurate and up-to-date. This helps businesses track their revenue and make informed financial decisions without delays.

- Better customer experience and support automation: The integration allows customer service teams to access complete payment history, transaction details, and previous interactions with ease. This results in faster, more personalized support. Automated workflows within Salesforce can trigger follow-ups or alerts, providing a seamless customer experience from payment to post-sale support.

By streamlining these processes, Salesforce PayPal Integration can significantly improve operational efficiency, customer satisfaction, and financial management.

How PayPal Enhances Salesforce CRM Functionality

PayPal enhances Salesforce CRM functionality by streamlining payment processes and improving operational efficiency. One way it does this is by allowing businesses to embed PayPal buttons in Salesforce pages. This makes it easy for sales teams to quickly initiate payments directly from the CRM, providing a smooth transaction experience for customers.

With PayPal integration, you can track payment status within CRM records. This means sales reps can easily monitor the status of each payment without switching between platforms. Having all the payment information in one place keeps teams informed and reduces errors or delays in processing.

Another key benefit is automating invoicing and reminders. Once payments are processed through PayPal, Salesforce can automatically generate invoices and send payment reminders to clients. This eliminates manual tasks and ensures invoices are sent promptly, improving cash flow.

Lastly, PayPal integration enables a streamlined quote-to-cash workflow with fewer touchpoints. By syncing payment details with Salesforce, businesses can move from quoting to cash collection in fewer steps, reducing administrative overhead. This seamless process helps close deals faster and keeps customers happy.

Challenges in PayPal Salesforce Integration

- API rate limits and token expiration: Restrictions on the number of API calls can slow down integration.

- Transaction sync delays: Delays in syncing transaction data may lead to inconsistent records.

- Complex Apex-based customizations: Customizing PayPal integration using Apex can be complex and error-prone.

- Data security and compliance (PCI-DSS): Ensuring secure transactions and meeting compliance standards like PCI-DSS is crucial.

- Dependency on middleware reliability: Relying on third-party middleware tools for integration may affect performance and stability.

Real-World Use Cases

eCommerce: Cart Abandonment Emails + Payment Links via PayPal

Example: An online store sends an email reminder to customers who left items in their cart. The email includes a PayPal payment link to encourage quick checkout, improving conversion rates and minimizing abandoned carts.

SaaS: Automated Invoice Generation Post Signup

Example: A SaaS company integrates PayPal with Salesforce to automatically generate invoices once a user completes a sign-up. This process eliminates manual billing and accelerates the payment cycle.

B2B: Embedded PayPal Payment Button in Quote Email

Example: A B2B business includes a PayPal payment button in a quote email. This allows clients to instantly make payments, streamlining the approval and payment process for faster revenue collection.

Future of PayPal-Salesforce Integration

The future of PayPal-Salesforce integration is exciting, with numerous innovations on the horizon. One promising development is the rise of GPT-powered payment assistants. These AI-driven assistants will help businesses offer personalized payment support directly within Salesforce, enhancing the customer experience.

Conversational payment bots in CRM will further streamline the payment process. By integrating PayPal with Salesforce, these bots will enable customers to make payments through chat interfaces, all while offering real-time support and enhancing overall service efficiency.

With AI-driven fraud prevention workflows, businesses can better protect transactions. Integrating AI within PayPal and Salesforce will help identify potential fraud patterns before they happen, keeping payments secure and reliable.

Finally, low-code flows to build custom payment journeys will allow businesses to create personalized and flexible payment experiences without deep technical knowledge. This will make it easier for companies to tailor the integration to their specific needs, all while maintaining ease of use.

FAQs

Q1: Can Salesforce integrate with PayPal?

Yes, Salesforce can integrate with PayPal through native integrations, third-party tools, or custom API setups. This integration allows businesses to manage payments directly from within their CRM.

Q2: How do I add PayPal to Salesforce?

To add PayPal to Salesforce, you need to set up a PayPal Business account, configure the integration using PayPal’s API, and create a connected app in Salesforce. You can also use third-party tools like Zapier for an easier setup.

Q3: Is PayPal API free to use with Salesforce?

The PayPal API is free to use, but there may be transaction fees for payments processed through PayPal. Using it with Salesforce may involve some additional costs depending on the integration method you choose.

Q4: What are the best tools for PayPal Salesforce integration?

Some of the best tools for PayPal Salesforce integration include Zapier, Workato, and Mulesoft. For custom setups, you can use PayPal’s REST API with Apex in Salesforce.

Q5: Can I track PayPal payments in Salesforce CRM?

Yes, once integrated, you can track PayPal payments in Salesforce CRM. Payment status, invoices, and transaction data are synced with Salesforce records for easier management and reporting.

Final Thoughts

In today’s fast-paced digital world, integrating PayPal with Salesforce is essential for businesses looking to streamline payments and CRM functions. By unifying your payment and customer data, you can improve cash flow, eliminate manual processes, and enhance customer relationships.

This integration offers a seamless experience that not only saves time but also drives better customer support, faster payments, and more accurate financial tracking. Whether you’re in eCommerce, SaaS, or B2B, the PayPal Salesforce integration can transform how you manage transactions.

Ready to simplify your payments? Contact Rolustech today for expert custom PayPal Salesforce integration services and take your business to the next level!